maricopa county tax lien foreclosure process

Pursuant to this legislation tax liens eligible for expiration will include the original certificate and all related sub taxes in the expiration process. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale.

After advertisement and a public auction where bids are received the Board of Supervisors will convene a public meeting and may vote to sell the parcels to the highest.

. General Foreclosure. Introduction to Tax Lien Foreclosures In Arizona tax liens are sold at a public auction every February. Durango St Phoenix Arizona 85009.

Maricopa County AZ currently has 17620 tax liens available as of May 11. In order for the State to return these parcels to the tax rolls through a tax-deeded land sale Maricopa County must first offer the parcels at a public auction in which anyone may bid on the parcels. If you have not yet registered start by pressing the Tax Lien Web button on the Treasurers website home page in the Investor section.

A number will be assigned to each bidder for use when purchasing tax liens through the treasurers office and the online tax lien sale. The above parcel will be sold at Public Auction on. TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library.

You must have registered separately for the Tax Lien Web feature. HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647. Except Federal Holidays Customer Service.

There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. Shop around and act fast on a new real estate investment in your area. Next enter your buyer number click the Register Here button and follow the prompts to.

Find the best deals on the market in Maricopa AZ and buy a property up to 50 percent below market value. Monday June 27 2022 at 1100 am. Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value.

Judicial Foreclosure The judicial process of foreclosure is now required for tax lien holders. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. The property owner of records of the Mohave County Recorder according to the county recorders records OR.

If the tax lien is not redeemed within the specified timeframe then youll have the opportunity to pursue a foreclosure on the property. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Every year the counties have auctions to sell these unpaid property tax liens.

You have to wait three years after you buy the tax lien certificates to foreclose. That would mean that as of 2013 you can foreclosure any tax lien certificate purchased in 2010. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including the state a deed conveying the property described in the Maricopa County Arizona tax lien certificate Sec.

These listings may be used as a general starting point for your research. A cashiers check in the amount of 1108000 made out to Flood Control District of Maricopa County is required to be an eligible bidder. Shop around and act fast on a new real estate investment in your area.

For more assistance with your research please speak with an Information or Reference Services staff member. Buying Selling Real Estate Discussion Found a property with a tax lien against it. After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property.

Maricopa County County AZ tax liens available in AZ. At least 30 days before filing for foreclosure complaint you must send notification to the following addresses of your intent to foreclose. The attorneys here have been involved with a form of Arizona real estate investment known as Certificates of Purchase CP or real property tax liens for the past twenty-four years.

Those liens with deadlines that are already in effect will not be affected however it will affect all future sub taxing liens so that the deadline will expire within a ten year period after the last day of the month that it was acquired and time. However if you buy subsequent tax liens on the same property you. For example Maricopa County conducts its on-line auction in February of each.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. 8am - 5pm Monday - Friday. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. SELECTED LAWS REGULATIONS AND ORDINANCES. Prior to initiating the court action the CP holder is required to give the property owner a minimum of thirty days notice by certified mail of the impending foreclosure.

Now what May 7 2021 1125. Judicial foreclosure involves filing a lawsuit with the court to obtain a court order to foreclose. What is the tax deed process.

Shop around and act fast on a new real estate investment in your area. Maricopa County CA tax liens available in CA. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. The amount owed in taxes becomes the amount of the lien but the interest rate is generally determined by the bidding process at the sale--investors bid down the interest rate in whole numbers starting at 16. Flood Control District of Maricopa County.

Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. All groups and messages. Maricopa AZ tax liens available in AZ.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. 2a The property owner according to the records of the Mohave County Assessor and.

Mobile Merchant License City Of Tempe Az

Why Litigation Support Should Be Outsourced Tax Lawyer Litigation Support Legal Support

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

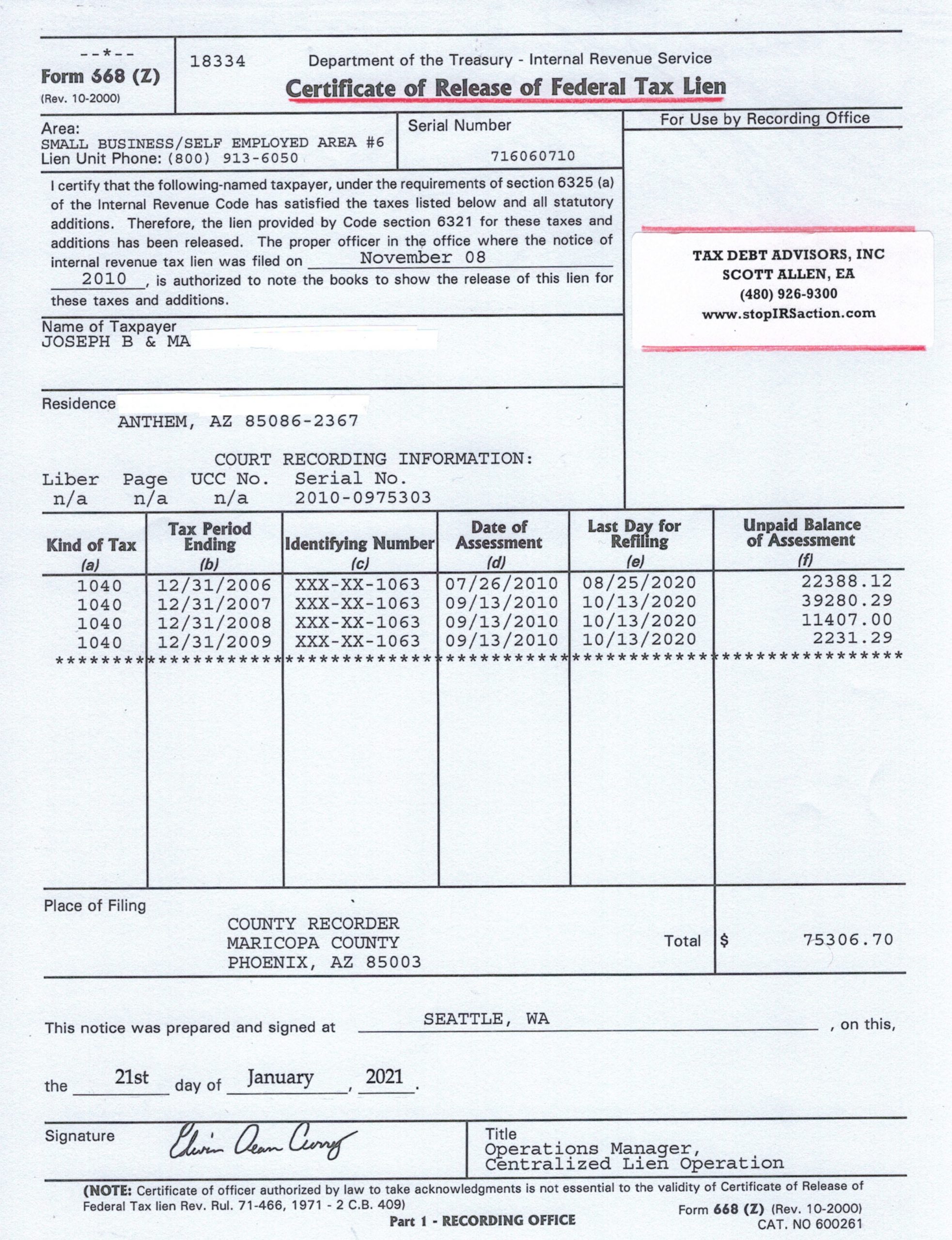

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

We Re Still Open And While Everyone Is Working From Home And Trying To Remain Calm We Hope To Be The Positive Tomorrow Will Be Better Feelings All About Time

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Aztaxes Gov Filing An Electronic Transaction Privilege Tax Return With Multiple Line Items Youtube

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Https Www Iii Org Article How To Save Money On Your Homeowners Insurance Home Buying Process Home Equity Loan Home Equity